Guide to purchasing the right one

Medical costs resulting from an accident are covered by personal accident insurance. In the event of a partial or permanent incapacity, the insurance compensates the insured. The family is given a lump sum payment if the policyholder dies in an accident.

Accidents are unfortunate. In the space of a single second, life may drastically change. Having trustworthy personal accident insurance coverage is so essential.

| Rider or add-on cover | Rider or add-on cover | Mandatory cover in motor insurance | |

|---|---|---|---|

| What is covered | Accidental death, permanent total and partial disability, temporary total disability, children's education fund, etc | Accidental death & permanent disablement | Accidental death and permanent partial as well as total disablement |

| Sum insured | Higher amounts of sum insured | Sum insured is limited | Sum insured is limited depending on the level fixed by the IRDAI |

| Premium (cost) | Higher than the other options of riders/add-ons | Low. Premium varies across different insurers | Low. Premium is fixed by the IRDAI |

Difference of premium:

| 25 lakhs | Standalone cover | Rider or add-on cover |

|---|---|---|

| Yearly | ₹ 4,623 | ₹ 1,682 |

* The limit of the coverage is defined as Rs. 15 lakhs by IRDAI for Motor insurance

Essential characteristics and advantages of personal accident insurance

The following are the characteristics and advantages of the personal accident insurance plan:

Financial security: The plan's coverage protects your savings against financial obligations from personal injury or accident.

Medical expenses coverage: The plan covers all medical costs incurred while treating the damage and pays your medical bills.

Hospital confinement allowance: If an accident disrupts your regular income, the plan offers a daily cash allowance of Rs. 1000 for up to 30 days of hospitalization.

Children's education bonus: This insurance program also covers your medical costs and your children's tuition. In the case of your death or a prolonged disability, the plan provides your children under 19 with a lump amount.

Permanent total disability coverage: Receive up to 125% of the insured amount as compensation in the event of a permanent complete disability.

Claim-free bonus: For each year without a claim, the plan gives a cumulative bonus ranging from 10% to 50%.

Quick disbursals: Receive quicker claim disbursals processing, starting seven working days after all requirements are met.

Every person needs personal accident insurance. Even with all due care, accidents do occur. Death or severe/permanent impairment are possible outcomes of this. In this case, personal accident insurance is crucial to life and health insurance.

Here are the reasons to choose personal accident insurance:

• Family financial stability

• Get the most dependable plans for families.

• Widespread coverage

• No medical exams or documentation are required.

• Utilize a simple claim process

• Support available seven days a week

• individualised programs

• Purchase the family's and individual's most trustworthy plans.

Minor accidents are manageable since they don't result in considerable financial hardship and don't significantly impact daily life. However, serious mishaps profoundly impact people's physical and emotional health. Additionally, if the injury results in an economic loss, the expense of therapy is prohibitive and becomes much more onerous. Personal accident insurance can provide financial stability and mental comfort in times of need.

The personal accident insurance policy covers the costs of the insurance holder's physical harm, disability, disfigurement, or death.

These benefits are given to those injured while traveling by road, train, or air due to crashes, physical harm, burns, or fractures.

You Don't Need Personal Accident Insurance

IF

• you are sure you will not meet with any accident in your lifetime.

• you are confident that you will not be affected due to any severe injury restricting your ability

to work and earn.

• you are sure that you have done full-proof planning that in case of your permanent absence, your family household Expenses, Child Education, child marriage, etc., will be taken Care of.

OTHERWISE, YOU NEED THIS COVER!

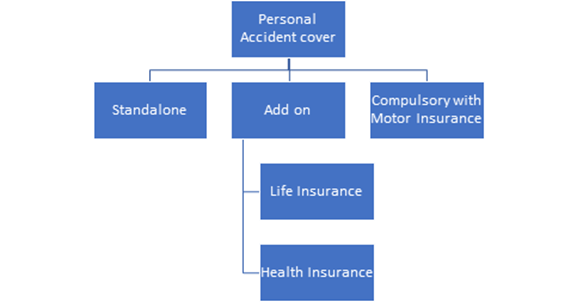

A standalone personal accident plan is better than the other coverage options because –

You get a broader scope of coverage

The sum insured levels are high

The plan is flexible and can be customized according to your coverage needs

Need assistance choosing the right term life insurance policy for you?

Want to know more about your coverage amount?

An accident insurance policy's claim procedure is quite simple. You must notify the insurer within the given time and then pick between submitting a reimbursement claim or using the cashless alternative.

Cashless claim

Anywhere in the nation, partner network hospitals offer cashless care to their patients. The steps to submit a claim are as follows:

Find a partner network hospital first in the city where you wish to receive cashless care (such as an Aditya Birla network hospital).

Notify the insurance provider 48 hours after admission (in case of an emergency hospitalization) and three days before admission (in case of planned hospitalisation).

Bring the patient's insurance cashless card or the policy details with you when you visit the hospital.

At the hospital's insurance desk, provide the cashless health insurance card and a valid ID.

Correctly complete and return the pre-authorization request form that is accessible at the hospital.

Fill out the request form on the official website and notify the insurer for faster response.

As your request is being considered, wait for the outcome.

After receiving your request, the insurer may take up to two hours to respond, and you will be notified of their decision through email and SMS.

Additionally, you can do so online. The claim will be processed in line with the terms and conditions of the insurance when all the requirements have been met.

In an emergency admission, you must notify the insurance within 48 hours and pay the hospital immediately unless the insurer has provided a pre-authorization.

Within 15 days of being released from the hospital, gather and submit the list of papers listed below.

After reviewing the documents, the insurer will decide on acceptance or rejection based on the terms and circumstances of the policy.

The insurance will NEFT the refund amount to the designated bank account if the request is granted.

Your registered contact phone number and email address will be notified if the request is denied.

Our team is happy to provide guidance and answer any questions you might have.

And the best part? Our assistance is completely free and with no obligations to purchase the insurance. Let us help you navigate the insurance landscape.